Comprehensive Research, Proven Strategies, and Expert Analysis

for Consistent Success in Every Market Condition!

-

Institutional quality research on the general market, asset class analysis, potential mania list, government watch list, Top/Bottom Relative Strength Stock List.

-

High Yield Portfolio

Strategy that made money for 30 consecutive years with average annual return > 10% with a max drawdown of 12% -

Uncorrelated Fund Portfolio

Investments in commodities and alternative investments that have low correlation to traditional equities and bonds -

Great combo with Reed’s Report

Portfolio Strategy Letter (PSL) and Reed’s Report complements each other wonderfully. Part of the inspiration for Reed’s Report was to have both a live delivery of content and a forum to get questions answered from the PSL

The Portfolio Strategy Letter isn’t some one-off unicorn...

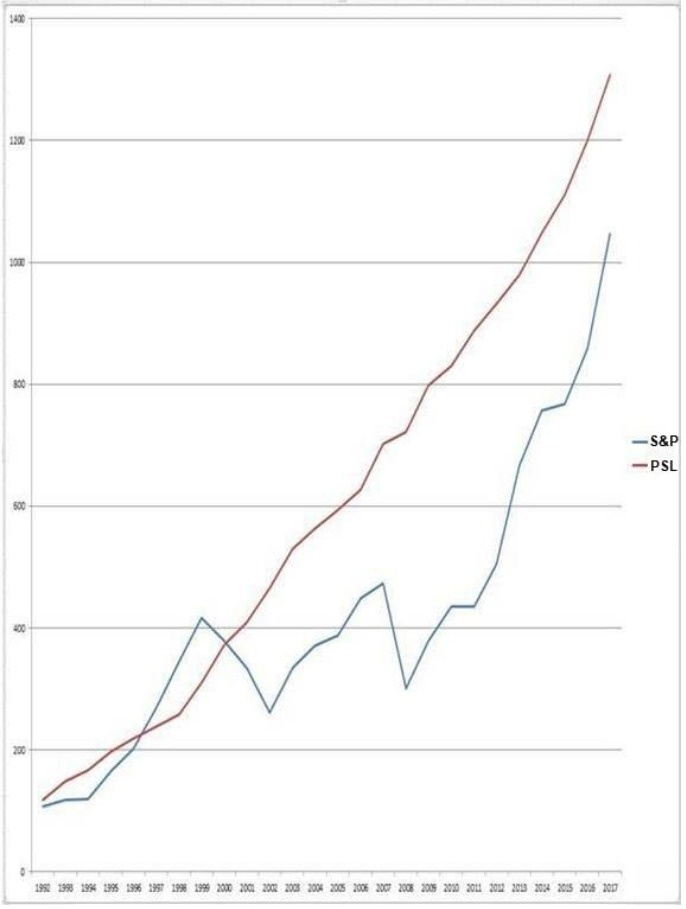

It has averaged over 18% a year for 30 years straight, made money in 29 of 30 years, and done that on a maximum worst case drawdown of under 12%, building over 4X the total return of the S&P on under a ¼ of the risk since 1992 real-time (an astounding record of profit and risk-reduction -see chart).

Fact is PSL has had better returns than most hedge funds you would have to pay 2% management fees and 20% incentive fees for, and many of the strategies in PSL have been licensed to hedge funds for millions of dollars over the last three decades.

The PSL total portfolio is a mix of all of our strategies that we asset-allocate among. It includes strategies on long/shorts, global stocks, US stocks, forex, futures, macro, high yield, gold, commodities, and highflyers.

How has this strategy, intact and published since 1992, done live and in real time? Take a look!

One of the longest running strategies in MRG Research and PSL, launched in 1992, has been our diversified high yield strategy.

This is kind of like a growth and income fund, where we mix our market timing backdrop with trying to mix a portfolio of bond-related vehicles with stock related vehicles, commodities when trending, forex when trending, and even some longs and shorts.

In many respects this is one of our simplest strategies and it makes potential changes about 10-12 times a year when PSL’s are published, although money managers can access it daily or weekly too.

Chart: The PSL Diversified High Yield strategy real-time since 1992 (red) versus the S&P (blue) - much more consistent annual gains, and much lower drawdowns smooths the path to investment gains.

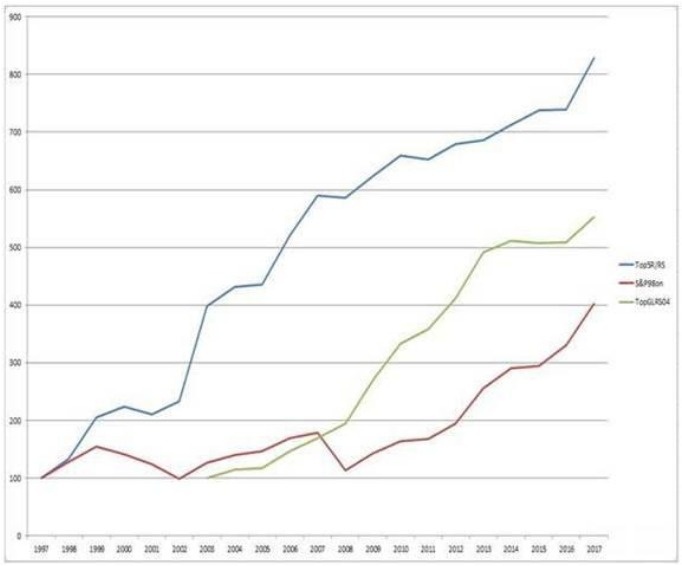

How did the Global Stock Strategy perform in 2000-2002 and 2007-2009 during the largest two bear markets since the Great Depression?

In 1998 PSL editor Mark Boucher wrote the book Hedge Fund Edge, published by Wiley Publishing. In that book Boucher revealed a thoroughly researched new strategy, the Top 5 Rate/Relative Strength Strategy. The book explained the strategy in detail and showed the performance of various components of it going back as far as the 1940’s. In 1998 we began publishing the Top 5 Rate/RS Strategy each month in PSL, and have continued doing so since, real-time, making it part of the Total PSL Portfolio mix of strategies from that point forward. The strategy simply switches to 5 ETF’s respresenting different countries markets each month, and steps to cash when bear markets appear or partially to cash when bear markets threaten.

Blue line is Top 5 Rate/RS Strategy since publication in 1998. Red line is the S&P since 1998. The green line is another model we introduced later.

"Having this knowledge of how the economy works will allow me to surf the waves instead of getting slammed." – Israel

“Your internal readings of the market and timing tools are the best I've ever seen after being a professional in the business for more than thirty years” - B Walicek, SuperTraderII graduate

Get the Portfolio Strategy Letter for $595/year